Finbites #21: cracking the Fintech Code. The path to glory and profitability

You have to be bold and a bit crazy to crack the profitability code in fintech.

Cracking the profitability code in Fintech is a terrible task. We've seen the neobanks question their ability to generate a solid income, especially during the Pandemic.

Like Apple disrupted years ago the mobile phone market, I think you have to be bold and a bit crazy to thrive in such a competitive landscape.

And the secret is now just selling the bare necessities every bank offer, but to nurture a long-lasting relationship with the client, offer them lots of great products, like overdrafts, personal loans, or credit cards, and if possible, reinvent them.

You can have an exceptional pre-paid card, but if you are not expanding to profitable niches and offer outstanding experiences with all the products, you'll lose in the long run.

Fintechs can't survive just from the interchange fees, and I developed this topic in a blog post about the Orange Money credit card, launched a few weeks ago. With an instant cashback incentive that resembles a subscription-based telecom package, Orange Money must create a large customer base to break-even.

This product has to be the first brick in building a relationship with the client, and many more have to follow.

Looking at some of the biggest neobanks like Starling and NuBank, we could see them reaching credit cards, overdrafts, personal loans and tapping into the business banking.

There's a lot to do for Orange Money, and other Fintechs that started with a pre-paid card, but this is the path to profitability.

Future Banking Meetup #2 - Staying safe in the online world

Join us Tuesday (February 9th), starting 10 AM, for a cybersecurity crash course (in Romanian) to get peace of mind in a digital world, where we pay by card every day and bank through the Internet.

Register for FREE at the Future Banking meetup and learn from ING Bank and Bitdefender experts how to keep your money safe and what to pay attention to when making transactions on the Internet.

Vlad Andriescu, editor in chief at start-up.ro, will moderate the debate.

Finqware’s €500K round and the challenges that Romanian fintechs face when raising capital from international VCs

Two weeks ago, the Romanian open banking startup Finqware announced raising a €500K round led by Elevator Ventures. Besides Finqware reaching a milestone (probably close to a €5 million price tag) this seed round is, as far as I know, the first international deal where the venture fund invested in a startup with LLC status.

Vlad Săndulescu (photo), attorney at law in the Romanian office of Schoenherr, and part of the team advising Elevator Ventures, told us that from a Romanian law perspective there is no legal restriction preventing such investments in LLCs.

Yet, structuring the transaction from a legal perspective might call for some creativity, but it is totally doable. Also, some limitations stem from the fact that in Romania, LLCs cannot have various classes of shares.

Find out below Vlad’s insights on the legal challenges that Romanian fintechs face when raising capital from international VCs:

International VCs will, understandably, expect legal documents to be aligned with international standards. This will require some clarification and adjustment work at both VC and start-up level.

As these types of investments are still relatively new in the local market, founders are seldom used to working with detailed contractual structures which regulate the investment terms and the rules for carrying out and managing the business once the VC investors come into the company.

For instance, many clauses relating to post-investment management and shareholding relationships which are standard in international practice, are not yet customary in Romania, especially in the context of limited liability companies (LLCs). Special attention to structural limitations and regulatory requirements will be required to legally frame and implement various investor rights and protections, such as control rights or specific management or advisory bodies in LLCs.

Also, some limitations stem from the fact that in Romania, LLCs cannot have various classes of shares. This is different from Romanian joint stock companies or standard international practice, where usually investors and founders of a company can hold distinct classes of shares, each having special or different rights and obligations attached. But this limitation in Romanian LLCs can be overcome in practice, by setting-up alternative contractual structures.

In the end, it is not impossible for VCs' and founders' interests to be aligned to both parties' satisfaction.

Fortunately, there have been more and more recent deals where VCs outside Romania have invested in Romanian start-ups and this has helped such businesses and their founders to understand and accept the benefits that VC investments bring. This is because VCs do not only put up funding, but they also bring valuable know how and networking resources which can be very useful in the management and development of the company they invest in.

“Buy now, pay later” startups to run into the regulatory wall

BNPL startups have become in recent years the Fintech industry darlings, with firms like Klarna and Affirm showing resilience and growth through the Pandemic.

The future looks promising as experts see increased M&A and listing activity (Clifford Chance - Fintech in 2021 report), but there are also signs of tighter regulation.

The UK's Financial Conduct Authority is to introduce new rules for buy now, pay later firms amid mounting fears of a growing debt burden for cash-strapped shoppers. (Finextra).

In the UK, the use of BNPL products nearly quadrupled in 2020, reaching £2.7 billion, with five million people using these products since the beginning of the coronavirus pandemic.

According to la latest figures, Klarna is adding one million customers each month, indicating that the BNPL trend is solid and getting mainstream.

The 30-second ad during the Super Bowl on February 7th is proof that Klarna is doing serious business.

Is Romania a sunny place for digital nomads?

Despite the Pandemic, the demand for ICT professionals is still very high and may rise further due to digitization processes that companies were forced to start after Covid.

Thus, the gap between the ICT workforce and companies’ demand, which was previously estimated around 20k specialists, may widen.

Can a Digital Nomad Visa be a solution for Romania?

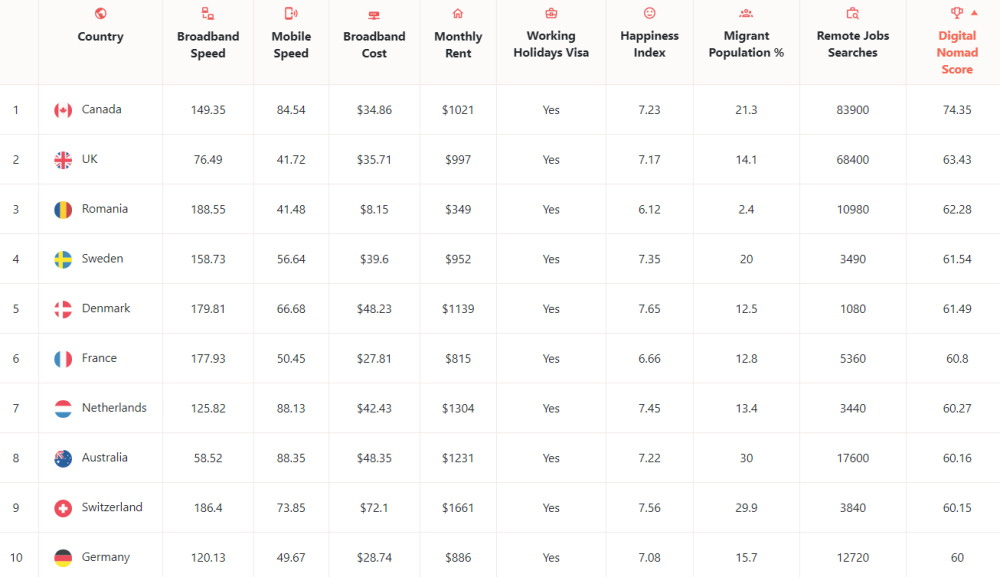

For starters, Romania already ranks very high in the top countries to be a Digital Nomad, according to Circle Loop Index. Taking the third spot, Romania is one of the fastest-growing information technology markets in CEE and has one of the cheapest average monthly fixed-line broadband costs. The cost of living is also much lower compared to developed countries.

If the Government adds to all these perks some tax advantages, Romania could become a sunny place for digital nomads.

To put things in perspective from a tax point of view, Greece has a Digital Nomad Visa that offers non-EU workers half tax for up to 7 years.

Georgia’s Digital Nomad Visa grants a tax-free benefit if you prove a monthly income of 2,000 USD.

The famous Digital Nomad Visa of Estonia provides a temporary residence permit but impose full taxation and requires a monthly income of 3,504 euros.

Croatia is the last of European countries to welcome digital nomads with a Digital Nomad Visa. You can find more details about it on Expat in Croatia website.

Jobs in Fintech & startups

With over 25 people developing Pago every day, the payment app that is being used by over 200,000 users in 2 countries is looking for a colleague in the customer support department.

The equity crowdfunding platform needs a patient professional to keep records of investors interactions, process investors requirements and to assist and/or prepare agreements and investment documents.

In an early-stage startup like Neurolabs, this role will focus on product discovery and go-to-market strategies. The product marketing manager will be working alongside the co-founders in shaping the product and making progress towards product/market fit.

After announcing a GM opening for Bucharest office, Revolut has listed another gig on Linkedin. The job description says that you will have to build tight relationships with key business, finance and tech journalists in Romania, in order to secure top tier coverage for the company across print, online and broadcast media.

As a growth hacker for a media outlet focusing on digital banking and Fintech, you'll be like the wizard/sorceress behind the scenes. By your viral content, video projects, podcasts & events engagement, you will prove to the world that a Romanian Fintech conference could become a go-to place in the region.

Other worth mentioning Finbites

Mastercard launched a digital banking solution developed by Ethoca that allows customers to get more details on their transactions, like the store's name, logo, or where the purchase took place.

The Romanian Fintech Association has a new board of directors. Cosmin Cosma will take the lead for the next 2 years

Here, you can watch the latest Fintech Friday interview with Cosmin 👇

The state-owned financial institution, CEC Bank, marked a new milestone in the digital transformation journey by launching a fully digital personal loan.

Right after announcing the new credit card product, I interviewed Haris Hanif, the CEO of Orange Money, and found how the pipeline of the telco-owned Fintech looks.

UiPath announced last week that it had closed a $750 million Series F round, elevating the post-money valuation to $35 billion.

If you haven't subscribed yet, now is the best time to do it. Sign up now, and don't miss the next Finbites newsletter.

📅 2 emails a month 📮 No spam, just Fintech 👋 Unsubscribe anytime.

By subscribing to the Finbites newsletter, you confirm that you are over 16 years old and wish to receive news and commercial information about events at this email address. You can find more details about processing personal data in Substack's Privacy Policy.